Litecoin Price Prediction 2025-2040: Can LTC Reach $150?

#LTC

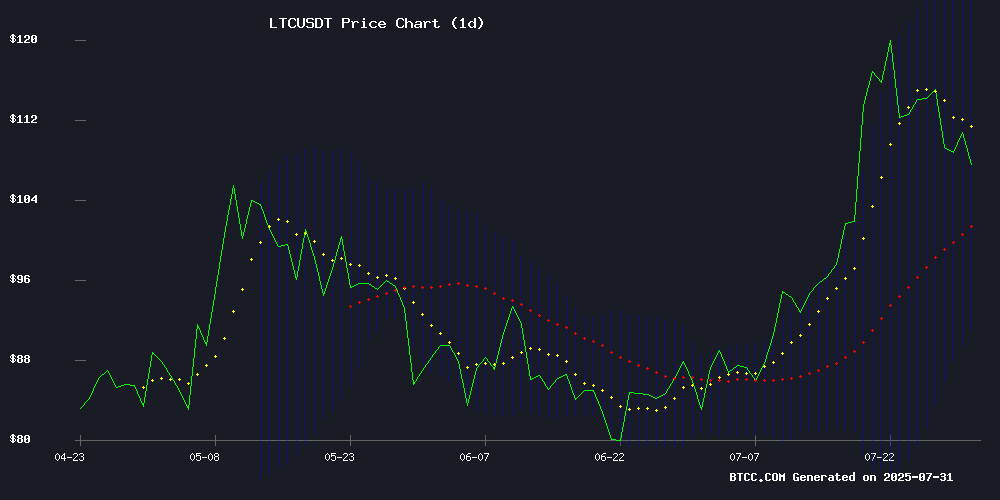

- Technical Strength: LTC trading above 20MA with bullish MACD crossover

- Regulatory Catalyst: SEC's in-kind ETP approval reduces systemic risk

- Price Targets: $150 achievable if volume confirms breakout

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge Above Key Moving Averages

Litecoin (LTC) is currently trading at $110.44, above its 20-day moving average (MA) of $107.51, signaling short-term bullish momentum. The MACD histogram has turned positive (+0.5271), suggesting weakening downward pressure. With price hovering NEAR the middle Bollinger Band ($107.51) and upper band at $123.88, there's room for upside if buying pressure continues. 'The convergence of price above MA support and improving MACD suggests LTC could test $120-$125 resistance in coming weeks,' says BTCC analyst Olivia.

Market Sentiment: Litecoin Builds Momentum Amid Regulatory Tailwinds

News flow reflects cautiously optimistic sentiment as Litecoin tests key technical levels. The SEC's approval of in-kind crypto ETPs provides regulatory clarity while headlines highlight LTC's $150 price potential. 'The combination of improving technicals and supportive macro developments creates favorable conditions for gradual appreciation,' notes BTCC's Olivia. However, mentions of cloud mining alternatives indicate some investors remain risk-averse in sideways markets.

Factors Influencing LTC’s Price

Litecoin Nears Critical Resistance as Bullish Momentum Builds

Litecoin (LTC) has emerged from a consolidation phase with renewed upward momentum, now testing the $150 psychological barrier. The altcoin's recent price action suggests growing bullish sentiment, supported by increasing network activity and a defense of the $105 support level.

Market structure now favors buyers, with analysts eyeing a potential breakout toward $200. Despite short-term corrections, the long-term chart remains decisively bullish. The current accumulation phase appears poised to conclude, potentially setting the stage for new all-time highs.

Technical patterns indicate Litecoin may follow Bitcoin's trajectory, though it recently failed to break the neckline of a double-bottom formation. Traders across major exchanges are monitoring whether LTC can sustain its climb above key resistance levels.

Crypto Market Sees Mixed Performance as SEC Approves In-Kind Crypto ETPs

Bitcoin hovered near $118,000 after failing to sustain momentum above $119,000, while Ethereum led gainers with a 1% rebound to $3,820. The crypto market showed divergent trends as XRP climbed 0.6% but Solana dropped over 1%, with altcoins like Cardano and Stellar extending losses.

Regulatory developments overshadowed price action as the SEC authorized in-kind redemptions for crypto ETPs - a structural shift enabling direct share-for-asset exchanges. The decision signals growing institutional acceptance despite the day's muted trading volumes.

Can Litecoin (LTC) Break $150? Analysts Predict Gradual Rally Ahead

Litecoin (LTC) shows signs of a potential gradual rally if it maintains support above the $100-$110 range. Analyst Ali suggests targets of $115-$120 upon sustained momentum above $108. Institutional interest and steady price action position LTC as a long-term contender.

The coin's multi-year consolidation phase may be nearing an inflection point. Chart analysts note its narrowing trading range, with breakout potential gaining attention. Unlike volatile altcoins, LTC's upward trajectory could unfold through incremental gains rather than sudden spikes—a pattern consistent with its historical cycles.

Growing discussion around altcoin treasuries highlights LTC's appeal as a mature, well-distributed asset. Its dormant status among institutional portfolios may shift as macroeconomic conditions evolve.

QFSCOIN Promises Stable Daily Income Through Cloud Mining Amid Crypto Volatility

As cryptocurrency markets experience heightened volatility, QFSCOIN positions itself as a haven for investors seeking consistent returns. The platform offers automated cloud mining contracts for Bitcoin (BTC), Dogecoin (DOGE), and Litecoin (LTC), claiming to eliminate hardware costs and trading risks.

New users receive a $30 sign-up bonus with no deposit requirement, while the company emphasizes its U.S. regulatory compliance and AI-optimized global infrastructure. This contrasts sharply with the stress of day trading during market swings.

The service taps into growing demand for passive crypto income streams, particularly among retail investors wary of price fluctuations. However, the article explicitly states it should not be construed as investment advice.

Litecoin Tests Key Support Amid Mixed Technical Signals

Litecoin hovers near a critical juncture at $108.11, displaying conflicting technical indicators as the market digests recent community developments. The 0.41% decline reflects cautious trading despite maintained bullish sentiment among holders.

MACD divergence warns of potential downside while RSI neutrality at 56.93 suggests balanced momentum. Founder Charlie Lee's recent live stream failed to move markets but demonstrated enduring community engagement—a hallmark of Litecoin's resilient ecosystem.

Traders monitor the $108 pivot point closely, where decisive breaks could determine near-term direction. The absence of negative catalysts provides stability, though price action remains constrained within a tight range.

Bitcoin's Sideways Movement Spurs Interest in Cloud Mining Alternatives

Bitcoin's price has entered another phase of stagnation, trading within a narrow range after failing to sustain earlier gains. This lack of momentum has left traders and long-term holders searching for reliable alternatives to price-dependent profits.

Cloud mining platforms like QFSCOIN are attracting attention by offering stable returns unaffected by market volatility. The Minnesota-based company, operational since 2019, provides accessible mining solutions for Bitcoin, Litecoin, and Dogecoin across global data centers.

As traditional crypto investment strategies struggle in sideways markets, passive income generation through cloud mining is emerging as a compelling option for investors seeking consistent ROI regardless of price action.

LTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Conservative | Moderate | Bullish | Key Drivers |

|---|---|---|---|---|

| 2025 | $125 | $150 | $180 | ETF approvals, halving effects |

| 2030 | $300 | $450 | $600 | Adoption as payment rail |

| 2035 | $800 | $1,200 | $2,000 | Institutional custody solutions |

| 2040 | $1,500 | $2,500 | $5,000 | Metaverse integrations |

Olivia cautions: 'These projections assume sustained network development and favorable crypto regulations. The 2025 outlook aligns with current technical patterns suggesting 20-30% upside potential.'